Has there ever been a greater need to strengthen the balance sheet and audit our accounts?

May 16th 2022

In April 2021 following the publication of the Island’s year end Financial Statements, The Sark Newspaper called for Chief Pleas to revalue the Island’s undervalued balance sheet and to reinstate a proper audit of the Island’s accounts. This April, following this year’s Financial Statements, it is again calling for the same changes. The Island’s 2021 statements were presented at the recent Easter meeting with some amount of celebration:

‘2021 saw a dramatic upturn in fortunes compared to the previous year. It resulted in a surplus of £206,683 for the year, which has boosted reserves back to pre-COVID levels and careful cash management has returned balances to over £1 million.’

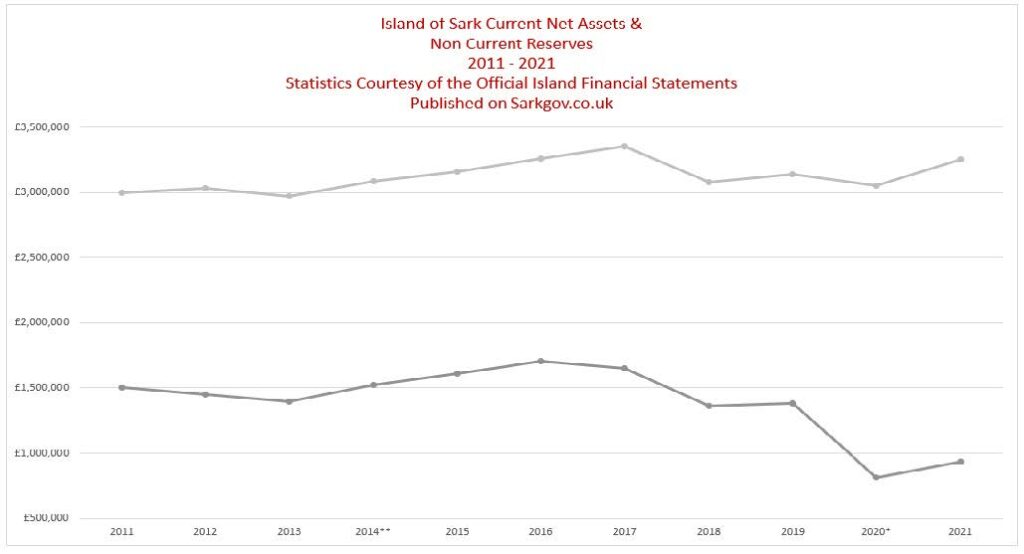

Whilst the general reserves have indeed recovered, the Island’s net current assets remain stubbornly diminished. Current assets are cash and other reasonably liquid items that are likely to be converted to cash within 12 months. The Island’s current assets began dropping in 2018 and, whilst the 2021 surplus has helped to bolster these cash flows, the balance of £930,973 is still only 55% of balances held in 2016 of £1,706,368. The changes in the Island’s cash flows over the past decade are concerning, but they are fairly reflected in the Financial Statements. The general reserves, on the other hand, are not fairly reflected in the Island’s statements.

These reserves have detailed a total book value of around £3 million for over a decade but the number has little base in any market reality.

Twice in Chief Pleas, Conseiller Kevin Delaney has referenced concerns that the book value of many of the Island’s assets fall short of their market value and that this situation needs to be addressed. In April 2021, Conseiller Delaney first requested change.

“Ivy Cottage, where the head master lives, I believe, is valued at £118,731, which strikes me as an incredibly low value, probably 25% of its true value … the teachers’ houses, in the plural, are valued at £98,295. The Visitor Centre, £34,217. I think you would be lucky to buy the granite alone for that!

I think there is an opportunity, at very little cost, to strengthen our balance sheet and give a far more accurate representation of what the Island’s assets are worth.”

According to the cadastre, property owned by the Island and held by the ‘Trustees for the Inhabitants of Sark’ totals 27 properties and the Island-owned properties comprise a total 44,235ft² of taxable floor space; this area includes 27,684ft² of domestic dwelling space. Some of these properties will be encumbered by long leases and some will be entirely unencumbered and at the disposal of the Island. Some will carry lease agreement ground rents and some will be tenanted with short-term tenants. The value of all these different properties and different arrangements will vary enormously, but they will all carry some amount of value and they should all be represented on the Islands’ balance sheet and indeed on its asset register, but at the moment, that isn’t the case.

Whilst there are 27 properties on the cadastre, there are only 15 properties on the balance sheet, and not all 15 comprise of the 27. As pointed out by Conseiller Delaney, those that even feature are all grossly undervalued.

12 months on and Conseiller Delaney was to be found making the same request at Easter Chief Pleas 2022 and asking that Policy & Finance move to strengthen the Island’s balance sheet. Delaney also made some interesting observations on the Island’s potential to borrow:

“When it comes to borrowing, I would also ask whether the Committee would have a look at the concept of whether we, as an Island, a self-legislating state, would be allowed to issue bonds … by my calculations at £200,000 we could probably issue a £4 million bond with a 5% coupon and I think that would be a very effective way of borrowing going forward. One might look at a 10- year bond, however, I would certainly, from my own perspective, wish to see us borrowing only for capital expenditure.”

In relation to borrowing, Conseiller Delaney also revisited the problem of the reviewed accounts:

“I felt that, with some of the challenges that we are going to have ahead of us with the public finances, we should seriously look at our accounts being audited. I think that it is almost inevitable that we are going to be borrowing at some point, in the not-too distant future. As we all know, governments have two ways of getting hold of money: they can either tax or they can borrow. I think that an important start on this would be that when we do go to borrow, we are in the strongest position to negotiate the lowest cost of finance.”

Unlike the States of Guernsey accounts, or indeed our own Island shipping company, the Island accounts are no longer audited.

The Island accounts were previously audited as a requirement of the 2008 Reform Law, but this is no longer. In April 2016 it was proposed that the Reform Law be amended and the requirement to have the accounts audited be removed. Agenda item 6 Easter Chief Pleas April 2016 states:

‘Regarding ‘Preparation of accounts’ it is proposed that an Audit is not currently considered appropriate for Chief Pleas’ accounts. Therefore the PDT proposes that in future, accounts are prepared and submitted for an Independent Review…’

No further explanation was provided and no questions or debate ensued; the proposals were carried and the changes were implemented. The difference between an audit and a review is significant. An auditor signs of accounts giving ‘reasonable assurance’ that financial statements are free of material misstatement – absolute assurance is impossible. A review engagement, like Sark’s, only ascertains that the financial statements are believable or plausible. A review only offers limited assurance that the financial statements even conform to generally accepted accounting principles. This type of assurance is known as negative assurance and is detailed by the reviewers on the front page of our annual financial statements:

‘To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Island of Sark for our review work, for this report, or for the conclusions we have reached.’

The Island’s financial statements are currently only useful as an internal document and it is time to return to a proper audit. An audit provides assurance to taxpayers and most audited accounts will raise our credibility.

The new Treasurer is doing an excellent job, but she is unqualified and an audit partner would afford her a liaison point. If the accounts were being thoroughly audited, it is possible that the auditors would already have advised us to update and revalue our balance sheet. With an eye to future public spending challenges, now is the time to strengthen the balance sheet and return to fully audited accounts.

This article first appeared in the Sark Newspaper : May 16th 2022